Ecosystems will generate $60 trillion in revenue by 2025—which will constitute 30 percent of global sales in that year, according to McKinsey. This rise of ecosystems and digital platforms offers carriers an opportunity to take on new roles and new sources of revenue. The future of distributed insurance is embedded, and we understand that insurers struggle to build the technological and organizational foundations necessary for this approach. Insurance will be about protecting the embedded ecosystem transactions valuable to people and businesses.

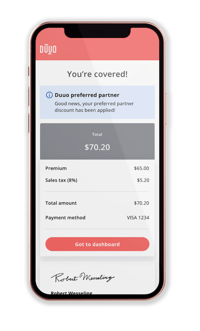

Building embedded insurance products for ecosystems has been, and will continue to be our focus. As early pioneers of the embedded products, such as Cyber with Microsoft, and Travel with Sompo, we have continued to refine our model and approach with all of our partners. We have also worked on a framework for the legal and regulatory aspects of embedding insurance into platforms and ecosystems, which allows insurance to be truly embedded into a single purchase. We place a lot of emphasis on ensuring the insurance buying experience matches today’s expectations in an ecosystem world.

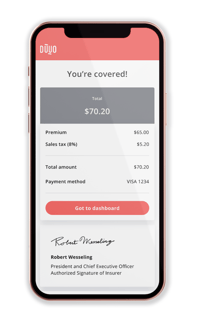

Take Duuo, for example, a 4 year old digital insurer built from the ground up with Slice, now has 7 products in market with 355 (and counting) ecosystem partners! They’re killing it in the Canadian marketplace.

A few Duuo partners include:

- Cando Apartments Ltd. (Property management partner)

- Highstreet Living (Property management partner)

- Bellamy Loft (Venue partner)

- Portobello West (Event organizer partner)

- Got Craft (Event organizer partner)

- Jiffy (Small Business Insurance platform partner)

Through all of our partnerships, we continue to build the future of insurance for an anytime, anywhere world. Learn more about what we’re building or reach out to us!